Referral marketing is a marketing strategy that leverages existing relationships and trust to drive new business. The key to success in referral marketing for financial advisors is consistently providing excellent service and building strong relationships with clients, as satisfied clients are more likely to make referrals

Why Are Referrals So Valuable to Financial Advisors?

Referrals are valuable to financial advisors for several reasons:

Cost-effective

Referral marketing is a cost-effective way for financial advisors to acquire new clients, as it does not require a large advertising budget.

Trust

Referrals from existing clients carry a high level of trust and credibility, which can help financial advisors establish trust with new prospects.

Targeted audience

Financial advisors receive referrals from people who are likely interested in their services, meaning that their marketing efforts are more targeted and effective.

Brand advocacy

When clients refer their friends and family to a financial advisor, they become brand advocates and can help spread awareness of the advisor’s services through word of mouth.

Credibility

Credibility is important in establishing trust with clients and building a successful business in financial advising.

Financial advisors can enhance their credibility by:

- Holding relevant certifications and licenses, such as the CFP (Certified Financial Planner) designation.

- Demonstrating a deep understanding of their client’s financial goals and objectives.

- Providing transparent and honest advice that puts the client’s interests first.

- Maintaining a professional and ethical approach to business and avoiding conflicts of interest.

- Building a strong reputation through positive client referrals and testimonials.

Quality Leads

Quality leads refer to potential clients interested in the financial advisor’s services and are more likely to become paying clients. These leads are often generated through various marketing and sales activities, such as referrals, online advertising, and inbound marketing.

The characteristics of quality leads for financial advisors include:

Relevance

They are interested in financial advisors’ services and need financial planning or investment advice.

Engagement

They have shown interest in the financial advisor’s services by visiting their website, downloading content, or reaching out for more information.

Fit

They are a good fit for the financial advisor’s target market and align with the advisor’s target client profile.

Budget

They have the financial means to invest in the financial advisor’s services.

Timing

They are ready to take action and are looking to work with a financial advisor shortly.

Client Growth

Client growth refers to acquiring new clients and increasing the size of a financial advisor’s client base. This is an important goal for financial advisors as it helps to diversify their business and generate more revenue.

There are several strategies that financial advisors can use to grow their client base, including:

Referral marketing

Encouraging existing clients to refer friends and family to their services.

Content marketing

Creating and distributing valuable content, such as blog posts, videos, and podcasts, to attract and engage prospects.

Networking

Building relationships and connecting with the local business community to find new clients.

Inbound marketing

Utilizing search engine optimization (SEO) and other digital marketing techniques to drive traffic to the advisor’s website and attract new prospects.

Lead generation

Building a process for attracting, nurturing, and converting leads into paying clients.

For example, a financial advisor may need to invest in building and maintaining strong relationships with clients and in creating and promoting a referral program.

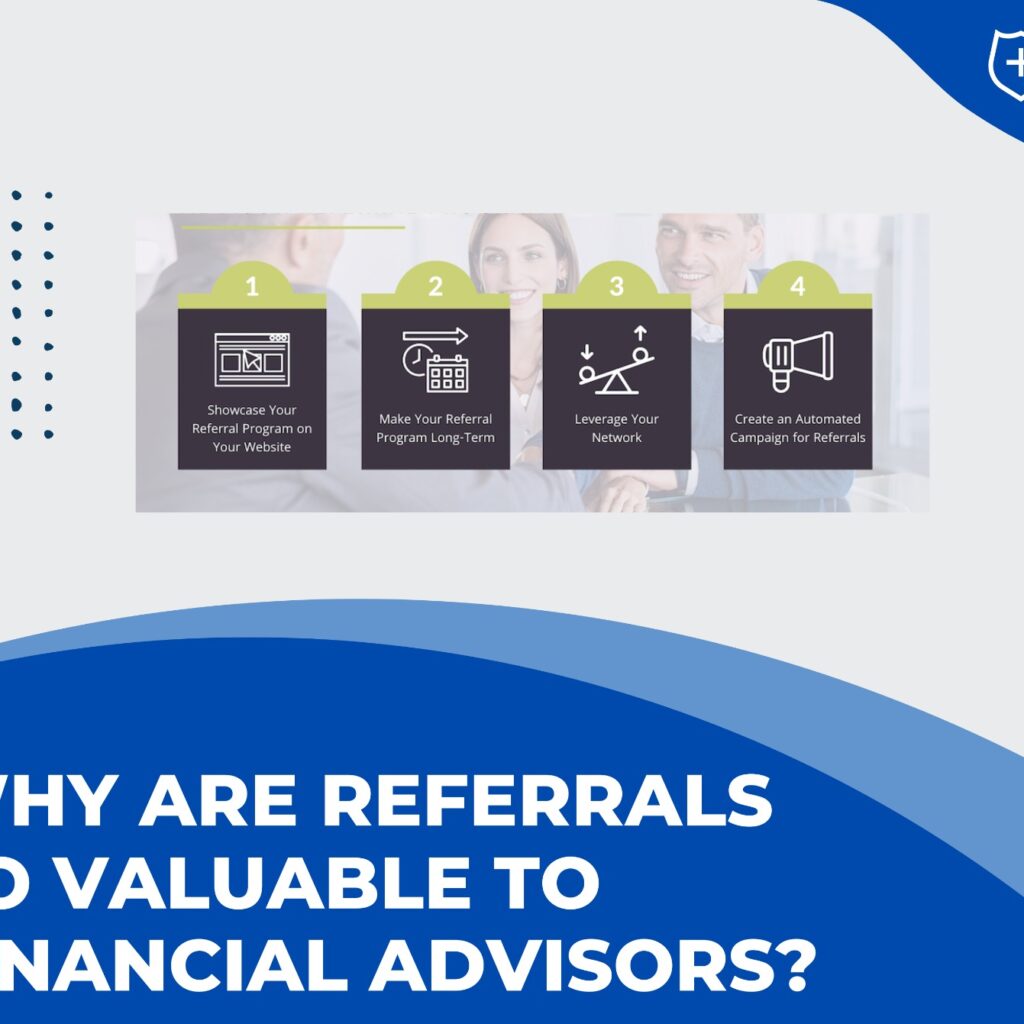

How Do Financial Advisors Get Referrals?

Financial advisors can get referrals by leveraging the relationships they have built with their existing clients. Here are several strategies that financial advisors can use to generate referrals:

- Ask for referrals

- Offer incentives

- Provide excellent service

- Nurture relationships

- Create a referral program

Leverage Your Existing Professional Network

Leveraging your existing professional network can be an effective way to generate referrals and acquire new clients. Here are several strategies for leveraging your professional network:

- Network with other advisors

- Attend industry events

- Connect with alum groups

- Join professional organizations

- Build relationships with local businesses

Incentivize Referrals

Incentivizing referral is a common strategy financial advisors use to encourage clients to refer their friends and family to their services. Here are several ways that financial advisors can incentivize referrals:

- Offer a discount

- Provide a gift card

- Host events

- Recognize referrals publicly

- Create a referral contest

Ask Your Long-Term Clients

Asking long-term clients for referrals is a proven and effective way for financial advisors to generate new business. Here are several strategies for asking long-term clients for referrals:

- Schedule a check-in

- Send a follow-up email

- Make it personal

- Provide a referral template

- Offer to reciprocate

Perfect Your Timing

Perfecting the timing of your referral request is an important aspect of generating referrals as a financial advisor. Here are several strategies for timing your request for referrals:

- Ask at the right time

- Follow up after a significant event

- Please wait for the right moment

- Ask regularly

- Timing

Add a Comment